Objective

This lesson will help you understand how people make decisions when faced with risk. You will learn about prospect theory, loss aversion, and the work of Daniel Kahneman, who studied why people sometimes make choices that are not logical.

3. Vocabulary Table

| Word | Definition |

|---|---|

| Prospect theory | A theory that explains how people make choices involving risk, often in surprising ways. |

| Loss aversion | Feeling more upset about losing something than happy about gaining the same thing. |

| Bias | A way of thinking that is not fair or balanced. |

| Utility | The amount of happiness or satisfaction something gives you. |

| Framing | Presenting information in a way that influences how people feel about it. |

| Heuristic | A simple rule or shortcut the brain uses to make decisions quickly. |

4. Reading Passage

Imagine this: someone offers you two choices. You can take $50 for sure, or you can flip a coin. If it lands heads, you win $100, but if it lands tails, you get nothing. What would you do?

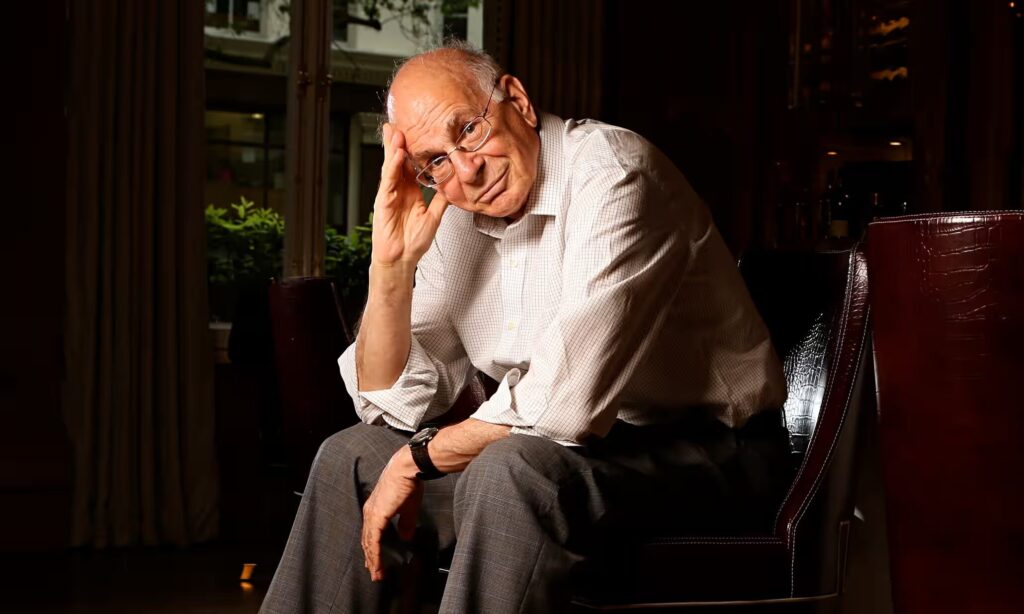

Daniel Kahneman, a psychologist, and Amos Tversky, his colleague, studied decisions like this. They found that people often avoid risks, even when the reward might be better. Their research, called prospect theory, explains why.

One of the main ideas is loss aversion. This means people feel the pain of losing something more strongly than the joy of gaining something similar. For example, losing $50 feels much worse than finding $50 feels good. Because of this, people often make safe choices to avoid loss, even if taking a risk could lead to more happiness.

Another part of the theory is framing. The way a choice is presented can change how people feel about it. For instance, if a decision is described as a chance to “lose,” people might avoid it, even if the result is the same as a “gain.”

Kahneman’s work changed how experts think about decision-making. His ideas help us understand why people buy insurance, save money, or avoid risky investments. By learning about these patterns, we can make better choices in life.

5. Summary Writing

Write a short summary of the article (4-5 sentences). Include at least two vocabulary words from this week’s list, and focus on the main ideas about prospect theory and loss aversion.

6. Vocabulary Practice

Exercise: Write a short paragraph (3-4 sentences) using at least two vocabulary words from the table.

Example:

When making decisions, framing can change how we feel about risks. If a situation sounds like a loss, loss aversion might make us avoid it, even if the outcome is good. Understanding this bias can help us think more clearly.

7. In-Class Questions for Deeper Understanding

- Analysis:

- Why do you think losses feel stronger than gains?

- How does framing influence decision-making? Can you think of an example?

- Why is prospect theory important for understanding everyday decisions?

- Personal Connections:

- Have you ever made a safe choice because you were afraid of losing something?

- Can you think of a time when framing changed your decision, like how a salesperson described a product?

- Critical Thinking:

- How can knowing about loss aversion help people make better financial decisions?

- Do you think it is possible to avoid all biases when making decisions? Why or why not?

8. Creative Writing Assignment

Write a short story or reflection inspired by the concept of loss aversion. Use at least three vocabulary words.

Prompt:

Describe a time when you had to decide between a safe and a risky choice. What made you feel unsure, and how did you decide?

Example Starting Line:

“I was standing in the store, holding the new phone I wanted. Should I spend the extra money or save it for something else? My fear of making a bad choice made the decision even harder…”